Fisher Investments or Ken Fisher Investments as it’s often referred to is a fee-only wealth management firm that claims to be set out to help those with a high net-worth to achieve their long-term investment goals.

It’s a company that seems to be especially of interest to those who are nearing retirement or planning their retirement early – but is Ken Fisher Investments good or bad? What is their performance like? Do they have any complaints? And what are the fees involved?

Those are all questions you’re undoubtedly asking if you’re considering letting Ken Fisher Investments manage your money, but thankfully you’ve landed in exactly the right place to find out all of the answers to them as I’ve taken a closer look into KFI & in this honest review I’ll be running over everything you need to know – including of course if investing with them is actually a good idea. ?

Before I start though I just want to point out that if you want to go straight to my no.1 recommendation for building an additional income then you can check it out via the link below:

Go here to see my no.1 recommendation for making money online

(This is a 100% free training for making 5-figures per month)

Table of Contents (Quick Navigation)

I really wasn’t kidding when I said I’d taken a closer look into Ken Fisher Investments, in fact I actually spent DAYS researching more about their company & their performance, which means, as a result, this review will be pretty “detailed” to say the least. To make things easier for you though I’ve put a together a table of contents below which you can use to quickly navigate the review & go straight to the information that you’re looking for. ?

- Who Are Fisher Investments?

- Who Is Ken Fisher (The CEO of Fisher Investments)?

- How Does Fisher Investments Work?

- What Are Fisher Investments Fees?

- A Look at Fisher Investments Performance

- What Is Fisher Investments Strategy?

- Ken Fisher Investments Complaints

- Is Fisher Investments a Scam?

- My Verdict on Ken Fisher Investments

- The BEST Way To Build An Additional Income

Who Are Fisher Investments?

Fisher Investments (as I very briefly touched on at the start of this review) is a wealth management firm that was actually founded over 35 years ago by a guy named Ken Fisher.

They launched in the USA, and they’re still based out of the USA – but they do now offer their wealth management/investment services in various different countries, including the UK.

In fact, Fisher Investments seem to pretty darn popular in the UK – and they’ve been offering their services to residents of the United Kingdom for over 20 years at the time of writing this review.

They also offer their services to Belgium, Canada, Denmark, France, Germany, Italy, Norway, Spain, Sweden and The Netherlands as well.

Now one of the reasons they have likely attracted a lot of attention & gained popularity is because unlike brokers they actually act as what’s known as a fiduciary, which means they have to legally act with their clients best interests in mind. So whereas brokers could (and often do) push people towards investing in things like mutual funds or annuities, Fisher Investments won’t push things like that onto their investments – instead they focus on what is actually of interest to the client, rather than what will earn them the most cash.

RECOMMENDED: Go here to see my no.1 recommendation for making money online

Another reason they have gained a lot of attention though is the fact that they run a “fee-only” model. This means that unlike some other wealth management firms Fisher Investments do not charge commissions on the products they sell – instead, they have simple, annual fees which are tiered & based on the size of your portfolio.

This also means that whilst Ken Fisher Investments primarily deal with people with relatively high net-worth, their “tiered” fee structure opens up their wealth management service for a wide range of portfolio sizes… And doesn’t leave it out of reach like many other management firms.

But anyway, aside from that – some notable things about Ken Fisher Investments include the fact that they’ve worked with over 50,000 private clients & currently manage over a whopping $105 billion in assets overall.

They have also been…

- Named one of the Financial Times’ Top 300 US-based Registered Investment Advisers (RIAs) in the publication’s annual list.

- Named one of InvestmentNews’ Top 10 US-based, fee-only Registered Investment Advisers (RIAs).

- Ranked #131 on the Pensions and Investments list of the World’s 500 largest money managers.

So yeah, it’s safe to say Ken Fisher Investments has a pretty solid history & has made some truly great achievements… But will they be a good or bad investment for you? That’s exactly what you’ll find out as you continue reading this review.

Firstly though before that…

Who Is Ken Fisher (The CEO of Fisher Investments)?

Ken Fisher is the main man behind Fisher Investments (hence the name), he’s the Fisher Investments CEO & founder so naturally you’ll probably want to know a bit more about him too.

So Ken Fisher, full name Kenneth Lawrence Fisher is, as you know, the founder of Fisher Investments – but prior to that he worked as an investment analyst & ran a popular column in Forbes named “Portfolio Strategy”.

His “Portfolio Strategy” column in Forbes ran all the way from 1984 right up until 2017 which makes him the longest-running columnist in the magazine’s history.

And right now he does actually still write columns for several other publications such as the Financial Times, USA Today & Interactive Investor – plus he has also authored a total of 11 books too.

But I know what you really want to know… How much is the man himself worth?

After all, if you’re letting somebody manage your money then it’s a good idea to make sure they can manage their own right?

Well, Ken Fisher’s net worth stood at around $3.8 billion in 2017 which secured him a spot on the Forbes list of the 400 richest Americans, as well as the Forbes list of billionaires.

So yeah, it’s pretty safe to say Ken Fisher probably knows a thing or two about managing money! And alongside that impressive feat, Investment Advisor magazine named him in their list of the 30 most influential people in the investment advisory business over the last 30 years.

It is therefore, I think you’ll agree, safe to say that Fisher Investments is backed by a solid figure in the investment business which is definitely reassuring, to say the least.

But enough about the man himself, more importantly…

How Does Fisher Investments Work?

The process of investing with Fisher Investments & having them manage your money is pretty straight forward & most importantly transparent.

The first step involves you reaching out to Ken Fisher Investments and discussing your goals. All of their plans are tailored towards focusing on your long term goals… So they’ll ask what you want to achieve, and they’ll discuss with you the best options to achieve it.

Should you decide to proceed further, they’ll then arrange for one of their representatives to set up a meeting with you to discuss it with your in-person – working around your schedule of course.

RECOMMENDED: Go here to see my no.1 recommendation for making money online

In the meeting, the plan will be discussed again, along with your goals – though this time it will be in more detail, running over everything, what they hope to achieve & how they hope to achieve it.

Then, if you decide to go ahead & invest – contact won’t end there (like it does with many wealth management firms). Fisher Investments has a proactive approach & you’ll actually be assigned your own dedicated Investment Counsellor.

The Investment Counsellor will serve as your day-to-day contact & you’ll be able to query anything with them, at any time. However it won’t be left to you to do the chasing, instead, the Counsellor will regularly reach out to you with updates on your portfolio & will also keep regular contact to ensure your investment strategy stays aligned with your lifestyle and goals.

What’s more Fisher Investments offer a flexible investment strategy to their clients, meaning if your goals or lifestyle do happen to change, so can your investment plan to align with it.

Alongside the contact from the Investment Counsellors you’ll also be provided detailed quarterly reviews and semi-annual capital markets update videos summarising the market outlook & analysis for the period.

Plus there’ll also be the option for you to attend in-person seminars at which you’ll have the opportunity to hear from the Investment Policy Committee and other senior members of the firm (which I believe run worldwide, not just in the USA).

What Are Fisher Investments Fees?

As I mentioned earlier in this review (and a few times throughout it), Ken Fisher Investments operate a “fee-only” policy – meaning they don’t charge commissions on any of the products they offer to their clients.

This benefits clients in two ways – firstly it means that it’s not in Fisher Investments interests to buy or sell investment products or trade your account frequently, and secondly it makes things much more transparent overall.

But what actually are the fees?

Well, Fisher Investments run a tiered fee structure which means that the fees they charge depend on the size of your portfolio – meaning obviously the more you wish to manage, the larger the fee will be… But similarly the less you wish to manage (or have to manage), the cheaper it will be.

Unfortunately though Fisher Investments does not make their fees public, and instead to find out the cost of managing your funds you would need to call them to discuss it with an advisor.

RECOMMENDED: Go here to see my no.1 recommendation for making money online

One thing I will add though is that whilst Fisher Investments may not charge additional commissions, you will incur trading fees directly billed by the third-party custodian housing your portfolio. However FI does claim that they work hard to make sure these trading fees are kept as low as possible, as ultimately Fisher Investments want to manage as much of your money as possible (since this makes them more money!).

A Look at Fisher Investments Performance

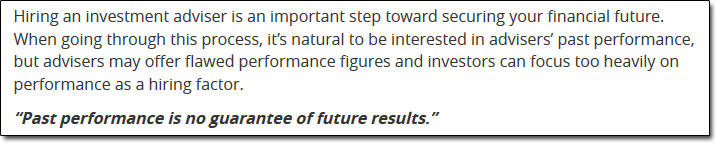

Well the Ken Fisher Investments website itself gives little away in terms of past performance, but the page regarding their investment adviser performance on their website states the following:

And I think the statement found on that page, that “past performance is no guarantee of future results” is very true. After all, you could look at 2 companies side by side – one that has produced an average 10% ROI for their clients over the past 5 years & another that has produced an average 1% ROI. This does NOT mean that the company providing the 10% ROI will do so next year – and actually, in terms of odds, the company producing the 1% ROI could be more likely to produce an increased average ROI the following year.

But of course naturally, when looking into a wealth management firm & considering investing money you are always going to have an interest with regards to how the company has done in the past… After all, you want to make sure at least that they’re not going to be reckless with your money.

So for that reason, I did some digging, and whilst I was not able to find a specific as such for Fisher Investments performance, I was able to find an article from Ken Fisher in which he stated: “you should expect average returns“.

He also said the following:

If you want to average about 10 per cent a year, that’s possible too – but you’re going to have individual years with huge volatility around that. And it’s still quite difficult to achieve even the market’s long-term average.

So overall from that article it looks like he is stating that 10%/year is a pretty bold goal to achieve (and I have to agree, as that is also, in my opinion, a pretty large ROI)… Which means if you’re considering investing in Fisher Investments and hoping for something around that figure – or potentially more than that, then you can probably think again.

Under 10%/year I’d say is a more realistic expectation in my opinion…

What Is Fisher Investments Strategy?

The Fisher Investments strategy is totally personalized depending on your goals & lifestyle as part of their “flexible investment approach”. The good news though is that your portfolio strategy will be managed by their Investment Policy Committee whose members have over 130 years of combined industry experience.

The managers at Fisher Investments do offer more than just stock picking though – they analyse the global markets, identify the most attractive investment categories & then look at choosing individual stocks, bonds or other securities for your portfolio.

They also educate you about what they’re doing so that you’re well informed of what’s going on rather than just having to put blind faith in the manager that’s taking care of your portfolio.

RECOMMENDED: Go here to see my no.1 recommendation for making money online

Plus on top of that through Fisher Investments you can also opt to leverage global investing… So for example, if you are living the US, you do not necessarily need to focus solely on US securities (as many Americans do). Through Fisher Investments you can invest globally to increase diversification & take advantage of opportunities many other money managers might miss.

And it’s also worth pointing out that depending on your goal, Fisher Investments can also leverage Bull and Bear market tactics on your behalf as well. Obviously nothing is guaranteed here & no money manager is correct every time, including Fisher Investments, but given that they have 35+ years experience & have seen many market cycles – I’d imagine they’d be able to offer an invaluable insight at least.

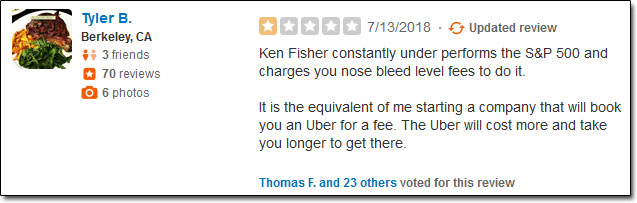

Ken Fisher Investments Complaints

Well as a good as Ken Fisher Investments seems to be, naturally with being such a huge company (managing over a whopping $105 billion in assets & working with over 50,000 private clients) there have been some complaints…

Now I am not publishing these complaints here to bring Fisher Investments down or anything like that, but I do feel that if you’re looking into a money management firm you deserve to know what other people have said about them.

So for that reason, I’ve put together this Ken Fisher Investments complaints section sharing what a few others have had to say about the company.

FYI the source of the following complaints was the Yelp review website, and it’s worth point out that the positive reviews of Fisher Investments did indeed outweigh the negatives (rating 3 out of 5 stars from 32 reviews).

Now onto another question that I’ve been getting asked a LOT about Fisher Investments (I guess you can’t be too careful)…

Is Fisher Investments a Scam?

No, no, no & no! Ken Fisher Investments as far as I’m concerned is definitely NOT a scam. It’s a long-running investment & money management company that is known worldwide.

Ken Fisher, the man behind the whole company, as I mentioned at the start of this review is a billionaire & hugely successful investor who has had the longest-running column in Forbes magazine’s history.

RECOMMENDED: Go here to see my no.1 recommendation for making money online

So if you’re wondering is Fisher Investments legit? The answer is an absolute yes – they are a HUGE company managing over $105 billion in assets & working with over 50,000 private clients.

They are based in the USA & still headquartered out of there but they also have offices all around the world including the UK, Belgium, Canada, Denmark, France, Germany, Italy, Norway, Spain, Sweden and The Netherlands as well.

Plus in countries like the UK, the client’s assets are held at independent, third-party custodians which means they’re covered by UK regulatory law rather than being moved out of the country & causing legal confusion in the event of a loss.

As also stated towards the beginning of this review too, Ken Fisher Investments has been:

- Named one of the Financial Times’ Top 300 US-based Registered Investment Advisers (RIAs) in the publication’s annual list.

- Named one of InvestmentNews’ Top 10 US-based, fee-only Registered Investment Advisers (RIAs).

- Ranked #131 on the Pensions and Investments list of the World’s 500 largest money managers.

So if you’ve heard any Fisher Investments scam rumours, rumours are all they are!

My Verdict on Ken Fisher Investments

As far as I’m concerned Ken Fisher Investments is a legitimate & popular money management firm which could be of especially great interest if you are nearing retirement or thinking about building up a “side-income” to see you through a more comfortable retirement.

As far as I’m concerned Ken Fisher Investments is a legitimate & popular money management firm which could be of especially great interest if you are nearing retirement or thinking about building up a “side-income” to see you through a more comfortable retirement.

But don’t just be left to think that they’re only useful for building retirement income – as I’ve mentioned several times throughout this review Fisher Investments have flexible investment approach which means they’ll come up with a plan to suit any goal or lifestyle.

Maybe you’re young & have wealth that you’re not sure how to manage? Fisher Investments advisers can help with that – and they could potentially help you build upon it too.

I mean ultimately in terms of money management nothing is guaranteed, but if I were to put my trust into a company to handle my money personally then I’d like to think I’d be able to rely on Fisher Investments – especially with them having an investment committee who have a combined experience of 130+ years.

So yeah it’s safe to say that overall Fisher Investments will be getting a thumbs up from me… But that doesn’t mean that Fisher Investments necessarily provide the BEST way to build your income…

The BEST Way To Build An Additional Income

I imagine that you were initially looking into Fisher Investments because you want to build upon your income & grow your wealth – either to enjoy retirement or just to enjoy life more in general & feel more comfortable…

Well, in my opinion, there is a better way to do exactly that, and I have put together a page on this website explaining more about that which you can access by clicking the link below:

Go here to see my no.1 recommendation for making money online

(This is 100% free training which shows you how I make 5-figures per month)

bzzzt.

Buyer beware: read the disclosure at the bottom of your screen, “If you buy through links on our site, we MAY* earn a commission”. *WILL

These folks want nothing from you, except to click on their link and shell out $30 bucks so they get their cut. They don’t care about you – this isn’t a public service and you have no idea who this person really is, what they did in the past, or if anything on the site is the truth. No evidence, no collaboration, nothing but a link wanting money.

Nuff said.

Hello, thanks for your comment. You *almost* came across as a smart person but if you take a closer look, you’ll realize there aren’t actually any affiliate links on this page. The disclaimer is just generic & does not apply here. Furthermore, in terms of “you have no idea who this person really is”, do feel free to read my about page.